Sss Contribution Table 2019 Philippines

There are basically two types of sss members employees and self employed voluntary member or overseas filipino worker sevmofw. 2019 sss contribution table for self employed voluntary or overseas filipino workers.

Updated Sss Contribution Table And Schedule Of Payment For 2019

Social security system 18 here is the latest and updated sss contribution table 2019.

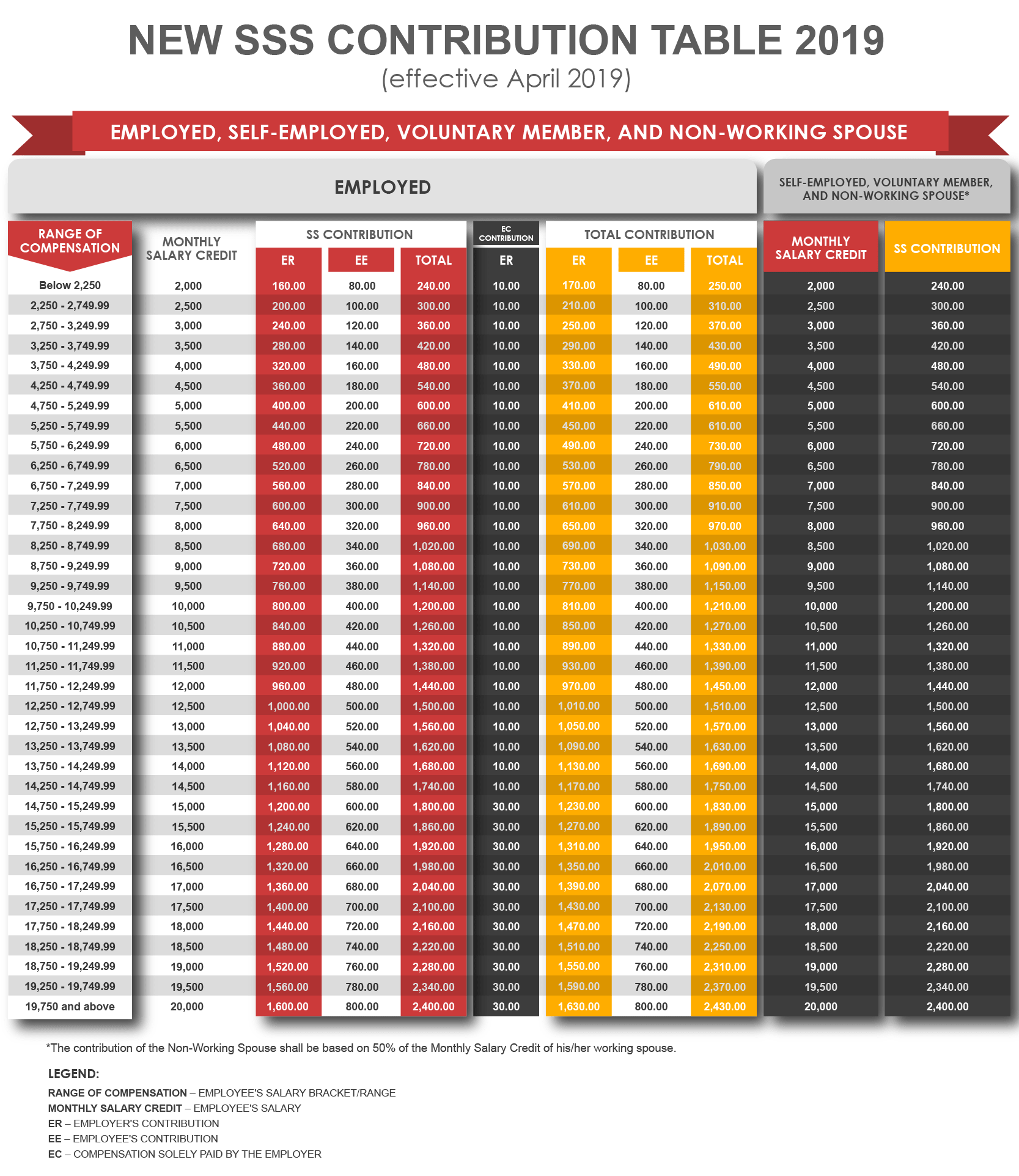

Sss contribution table 2019 philippines. 11199 or the social security act of 2018 the social security system sss issued sss circular no. New sss contribution table 2019 for employed self employed voluntary and non working spouse. Employed members are required to pay 12 of their monthly salary credit msc not exceeding p20000.

Sss contribution table effective april 2019 26 mar 2019 in accordance with republic act no. All employers employees self employed voluntary members and ofws must be aware of the this contribution table. Starting in april 2019 the contribution rates for members of the social security system sss will increase from its current rate of 11 percent to 12 percent.

Sss contributions of employed self employed voluntary member and non working spouse. 2019 05 on march 15 2019 prescribing the new contribution table that is effective in april 2019 as illustrated below. Sss contribution table 2019.

The minimum monthly salary credit msc for regular employed self employed voluntary member and non working spouse is two thousand pesos php 2000. Here is the new sss contributions table for employed self employed voluntary and non working spouse ofw and household members. The employer pays 8 while the employee pays 4.

The contribution rate for overseas filipino workers ofws earning less than p8250 monthly is p960 and p2400 for those with more than p19750 monthly. The sss contribution table above and the succeeding ones can be used only from april 2019 to the end of 2020 as the contribution rate will increase again in 2021 onwards. The new contribution schedule will be implemented for the applicable month of april and payable in may 2019.

Sss commissioner and officer in charge aurora ignacio stated that the increase in contribution rate is pursuant to republic act no.

Sss Contribution Table 2017 Sss Answers

Sss Contribution Table 2017 Sss Answers

2019 Sss Contribution Table For Voluntary Members The News Bite

Comprehensive Guide To Pag Ibig Contribution Online Verification

Sss Monthly Contribution Table Schedule Of Payment 2020 The

Sss Contribution Table And Payment Schedule For 2020 Tech Pilipinas

![]()

Philippines Mandatory Employee Benefits Contributions

Register New Employees With Sss Philhealth And Pag Ibig Fund

Sss Contribution Table 2016 2017 Voluntary Monthly Chart Guide