Basel Iii Requirements

Like all basel committee standards basel iii standards are minimum requirements which apply to internationally active banks. During credit expansion banks have to set aside additional capital while during the credit contraction capital requirements can be loosened.

Basel Iii Minimum Capital Requirements For Market Risk Frtb

Key principles of basel iii 1.

Basel iii requirements. A mandatory capital conservation buffer equivalent to 25 of risk weighted assets. A discretionary counter cyclical buffer allowing national regulators to require up. The basel iii requirements were in response to the deficiencies in financial regulation that is revealed by the 2000s financial crisis.

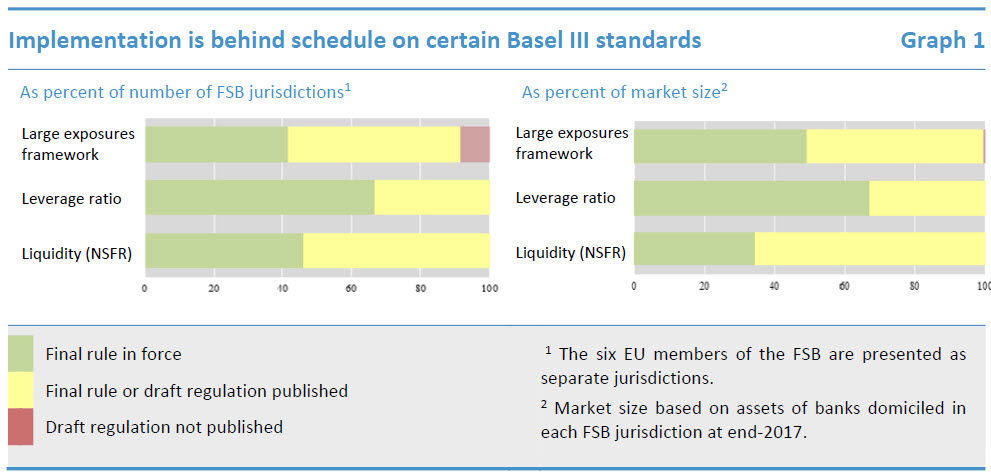

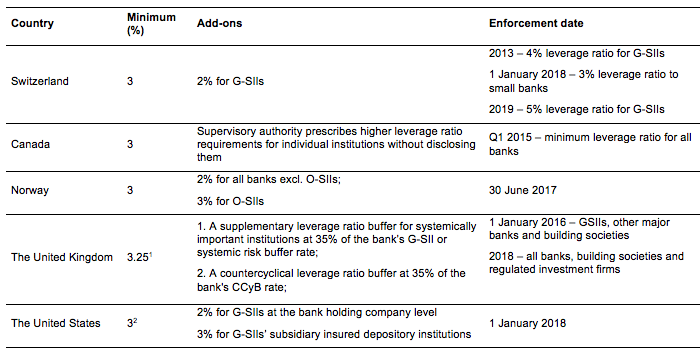

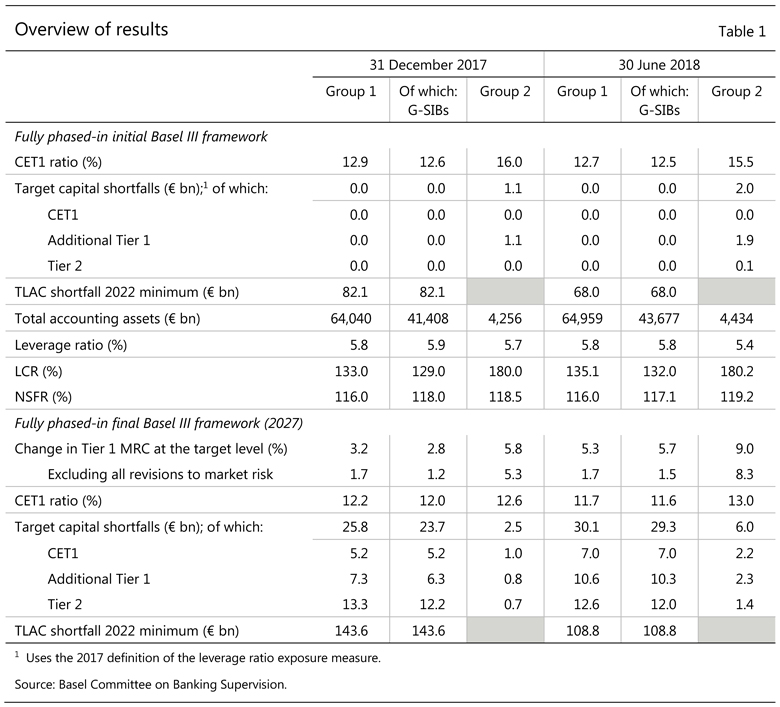

Basel iii introduced new requirements with respect to regulatory capital for large banks to cushion against cyclical changes on their balance sheets. The report looked at adoption status of basel iii standards by 30 global systemically important banks g sibs as of end may 2019. Basel iii was intended to strengthen bank capital requirements by increasing bank liquidity and decreasing bank leverage.

According to a report by the basel committee on bank supervision bcbs the reserve bank of india has fallen short of meeting tougher requirements set by the basel iii norms. Furthermore basel iii introduced two additional capital buffers. Considering the 45 cet1 capital ratio required banks.

Members are committed to implementing and applying standards in their jurisdictions within the time frame established by the committee.

Basel Iii Minimum Capital Requirements For Market Risk Frtb

Basel Iii Has Landed Full Details Ft Alphaville

Basel Iii Implementation Financial Stability Board

Basel 1 2 3

Https Www Ijitee Org Wp Content Uploads Papers V8i8 H6938068819 Pdf

The Leverage Ratio As A Macroprudential Policy Instrument Vox

Press Release Basel Iii Monitoring Results Published By The Basel

Basel Iii Implementation And Sme Financing Evidence For Emerging

Basel Iii The Final Regulatory Standard Mckinsey