Basel Iii Implementation Date

However implementation was extended repeatedly to 31 march 2019 and then again until 1 january 2022. The ghos has therefore endorsed the committees proposal to extend the implementation date of the revised minimum capital requirements for market risk which were originally set to be implemented in 2019 to 1 january 2022 which will constitute both the implementation and regulatory reporting date for the revised framework.

/BernankeBaselIII-c9563bd27fa84734a7cd5566d6c402a5.jpg)

Understanding The Basel Iii International Regulations

Basel iii capital requirements focus on reducing counterparty risk which depends on whether the bank trades through a dealer or a central clearing counterparty ccp.

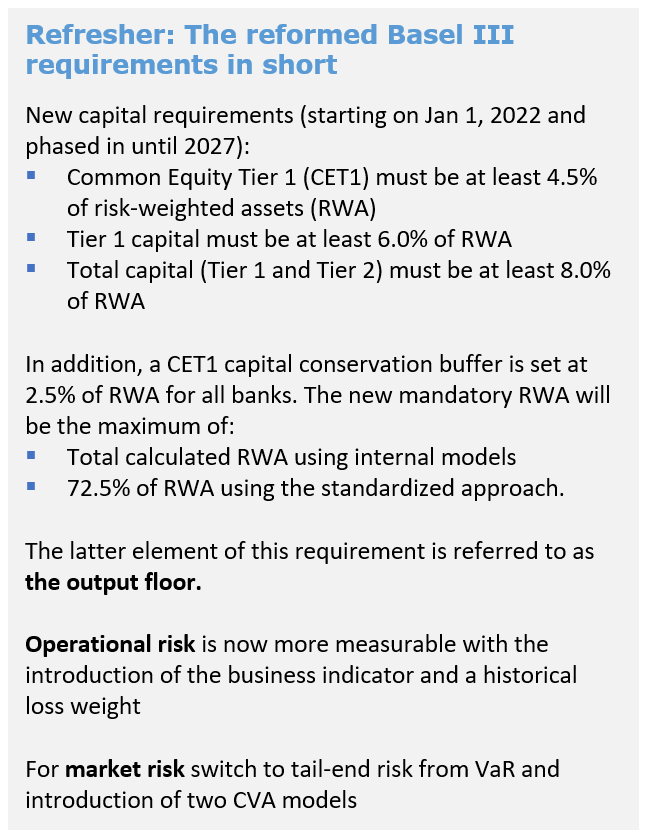

Basel iii implementation date. 2 basel iii. In december 2017 the group of central bank governors and heads of supervision which is the basel committees oversight body endorsed the finalisation of basel iii reforms that will take effect from 1 january 2022 and will be phased in over five years. The basel committee monitors implementation of the basel standards through its rcap regulatory consistency assessment programme established in 2012 to monitor and assess the adoption and implementation of its standards while encouraging a predictable and transparent regulatory environment for internationally active banks.

Despite the g20s objective of establishing a level playing field. Basel iii was intended to strengthen bank capital requirements by increasing bank liquidity and decreasing bank leverage. Deferring implementation of the revised market risk framework will align its start date with those of the basel iii revisions for credit risk and operational risk that.

The basel committee. However changes made from april 2013 extended implementation until march 31 2018. Banking agencies announce revised plan for implementation of basel ii framework april 29 2005 agencies announce delay in publication of notice of proposed rulemaking with respect to u.

The implementation of basel iii will affect the derivatives markets as more clearing brokers exit the market due to higher costs. In order to assess the impact of the full implementation of the new basel iii framework on the european banking system the eba conducts on a semi annual basis with data as of end june and end december a monitoring exercise on a sample of eu banks. Basel iii was agreed upon by the members of the basel committee on banking supervision in november 2010 and was scheduled to be introduced from 2013 until 2015.

The exercise is conducted on a voluntary basis. The g20 also endorsed very long transitional periods for full implementation of the basel iii capital and liquidity proposals. The fsb has designated basel iii as one of the priority areas for implementation monitoring.

Basel iii is an international regulatory accord that introduced a set of reforms designed to improve the regulation supervision and risk management within the banking sector. Implementation of basel ii january 27 2005 qualification process for basel ii implementation sr letter 05 1 november 3 2004. The basel iii requirements were in response to the deficiencies in financial regulation that is revealed by the 2000s financial crisis.

Issues and implications the background to a discussion on basel iii the recent g20 summit in seoul endorsed the basel iii agreement.

Pdf Basel Iii In Chile Advantages Disadvantages And Challenges

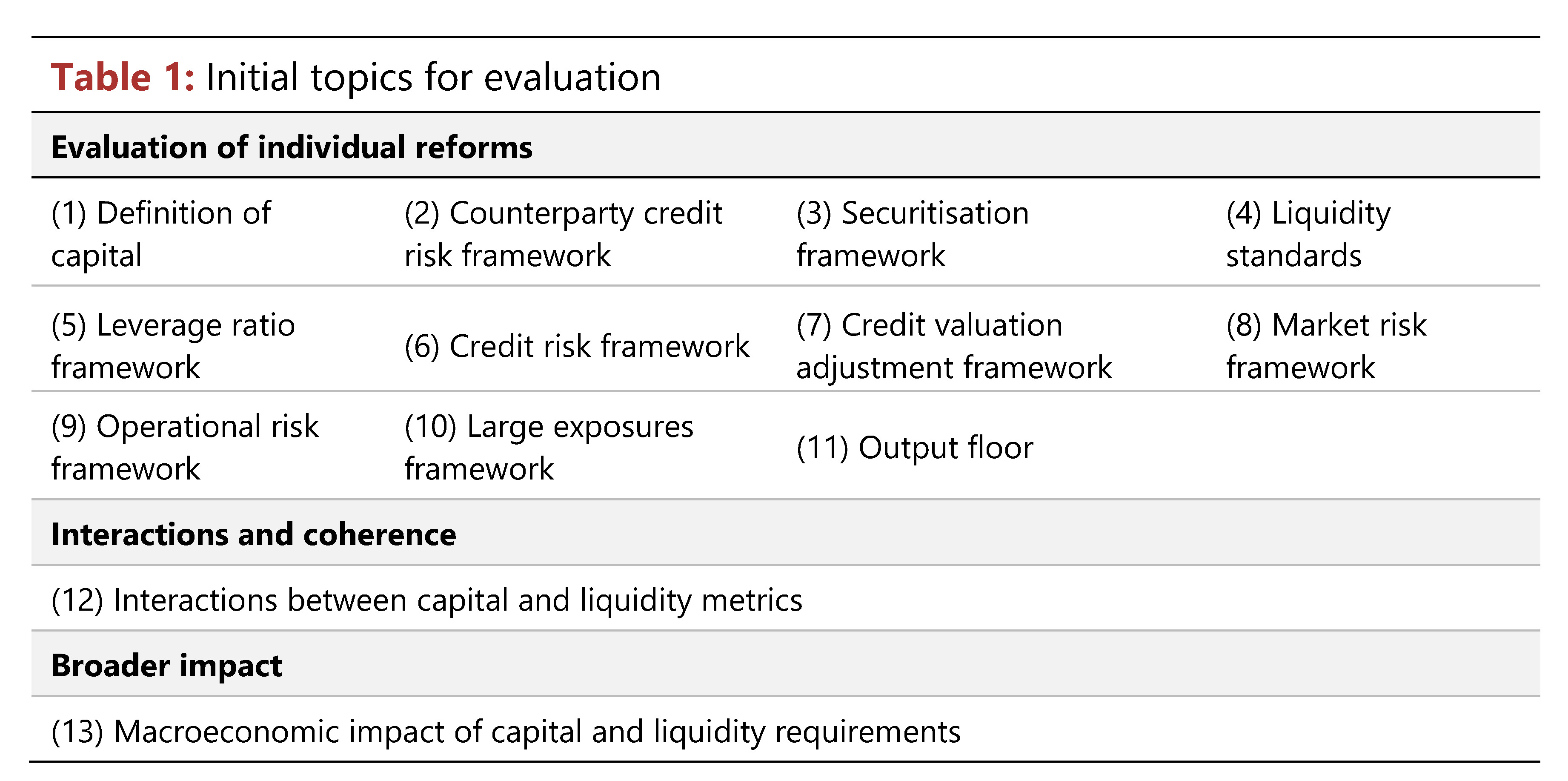

Post Basel Iii Time For Evaluation

Basel Iii Reforms What Will Impact Banks Most

Basel Iii The Final Regulatory Standard Mckinsey

New Capital Requirements Roadmap 13

Https Www Federalreserve Gov Secrs 2019 March 20190320 R 1629 R 1629 031819 133559 401384201417 1 Pdf

Pdf Readiness Of The Uae Banks For The Implementation Of Basel Iii

Basel Iii Liquidity Standards Restructuring On The Way Banking

Basel Iii