Sss Contribution Table 2020 Philippines

Employed members are required to pay 12 of their monthly salary credit msc not exceeding p20000. Updated sss contribution table 2019.

The New And Updated Sss Contribution Table To Be Effective In

Effective april 2019 below is the new sss contribution table for employed self employed voluntary members and non working spouses.

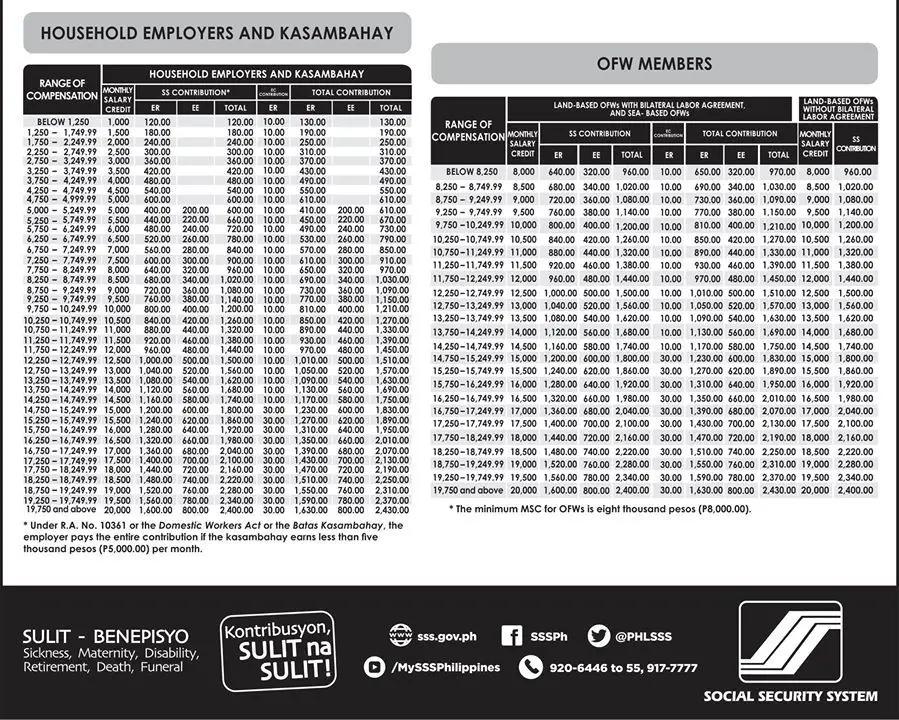

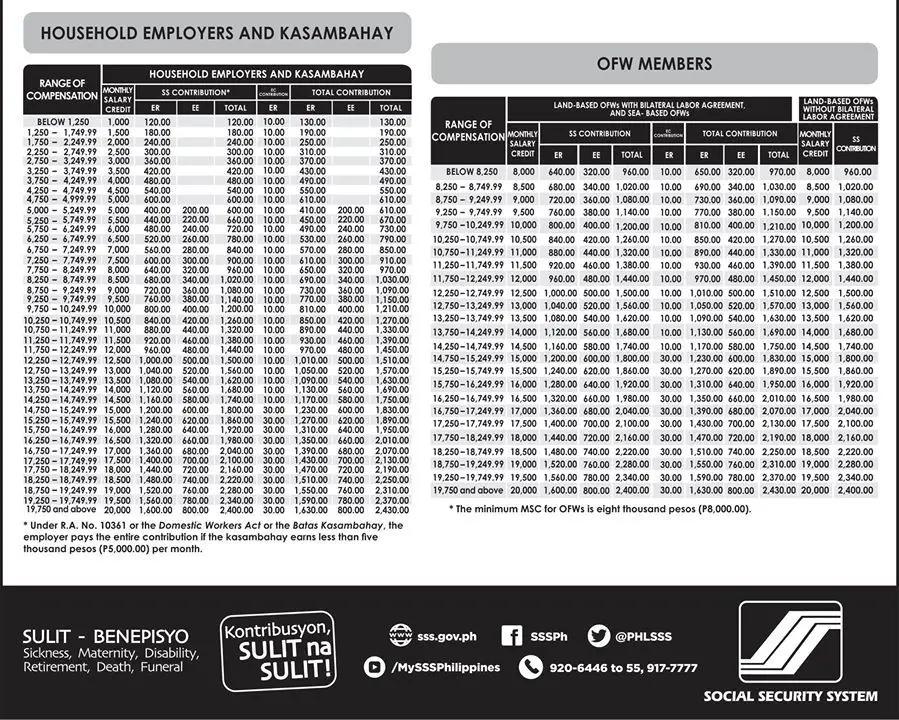

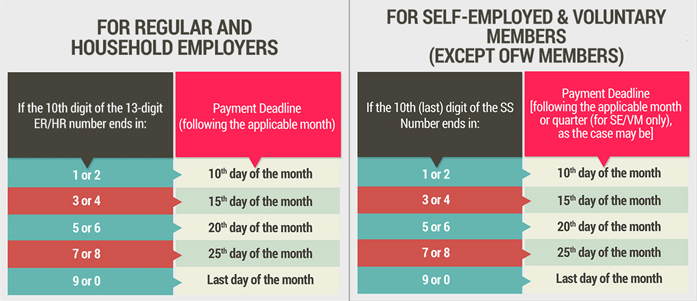

Sss contribution table 2020 philippines. Sss contributions table and payment deadline 2020 posted by. The updated sss contribution table starting april 2019 for employees and employers voluntary self employed ofw and kasambahay or household workers to have at least a rough idea on how much contributions are. Sss contributions of employed self employed voluntary member and non working spouse.

The state run social security system sss said monday it released more than p1901 billion worth of salary loans to around 942000 members in the first six months of 2019. 632 8920 6446 to 55. The employer pays 8 while the employee pays 4.

Revised premium philhealth contribution table 2020 for those earning below the salary floor of p10000 contributions are computed using the minimum threshold. Sss contribution table 2019 with computations heres the latest version of the sss monthly contribution table 2019 which will be used to compute the monthly premiums to be paid by all social security system sss members including new required members ofw and kasambahay starting april 2019. While those who earn the set ceilingslimits shall pay premiums based on the set ceiling.

For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430. Sss contribution table 2020 last updated jan 4 2020 social security system sss is a philippine social insurance program to workers in the private professional and informal sectors. This policy shall also apply to seafarers.

The sss contribution table above and the succeeding ones can be used only from april 2019 to the end of 2020 as the contribution rate will increase again in 2021 onwards. Sssinquiriesadministrat0r december 26 2019 if you want to download the sss contributions table 2020 then you may double click this image and save on your phone for your handy reference. Sss releases over p19b worth salary loans to nearly 942k members in h1 2019.

There are basically two types of sss members employees and self employed voluntary member or overseas filipino worker sevmofw. Sss contribution table 2020. For comments concerns and inquiries contact.

Sss Contribution Table 2020 With Detailed Computations

New Sss Contribution Table 2019 Effective April 2019

Philhealth Contribution Table For 2020 Noypigeek

New Sss Contribution Table Effective April 1 2019 Serve Pinoy

Sss Monthly Contribution Table Schedule Of Payment 2020 The

Sss Contribution Table 2020 Sss Benefits For Filipinos

Download This Sss Retirement Pension Calculator Updated 2019

Sss Contribution Table For 2020 Noypigeek

New Philhealth Contribution Table 2020 Employee Employer Share