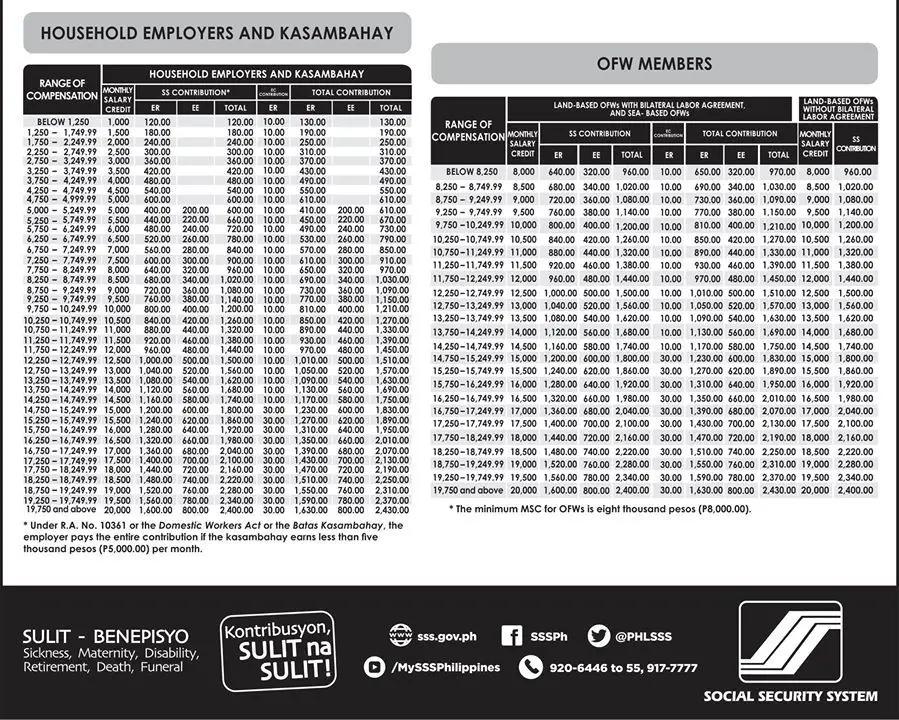

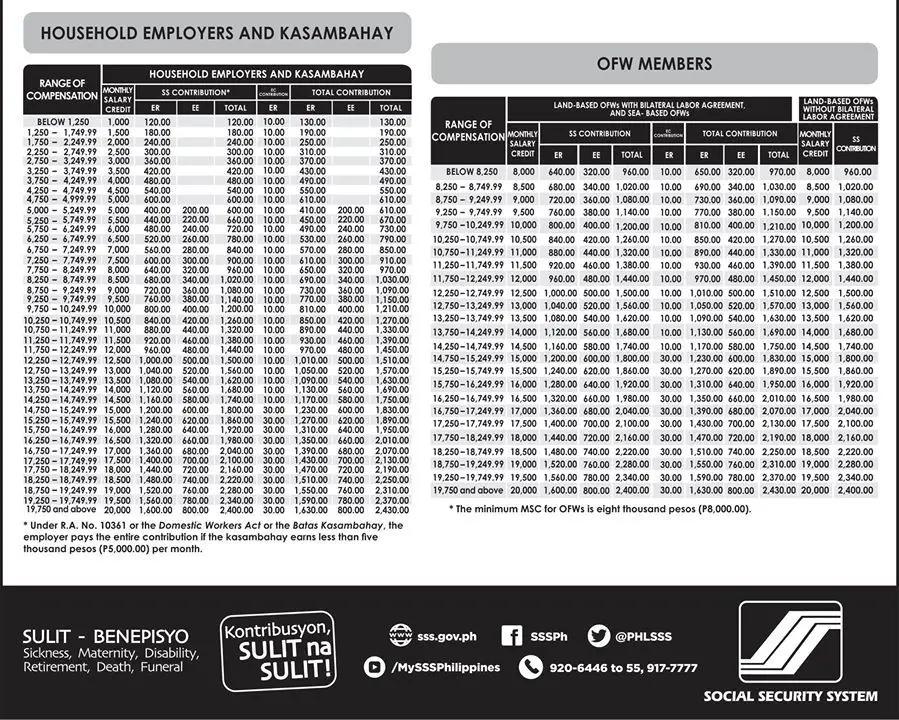

Sss Contribution Table 2017 Philippines

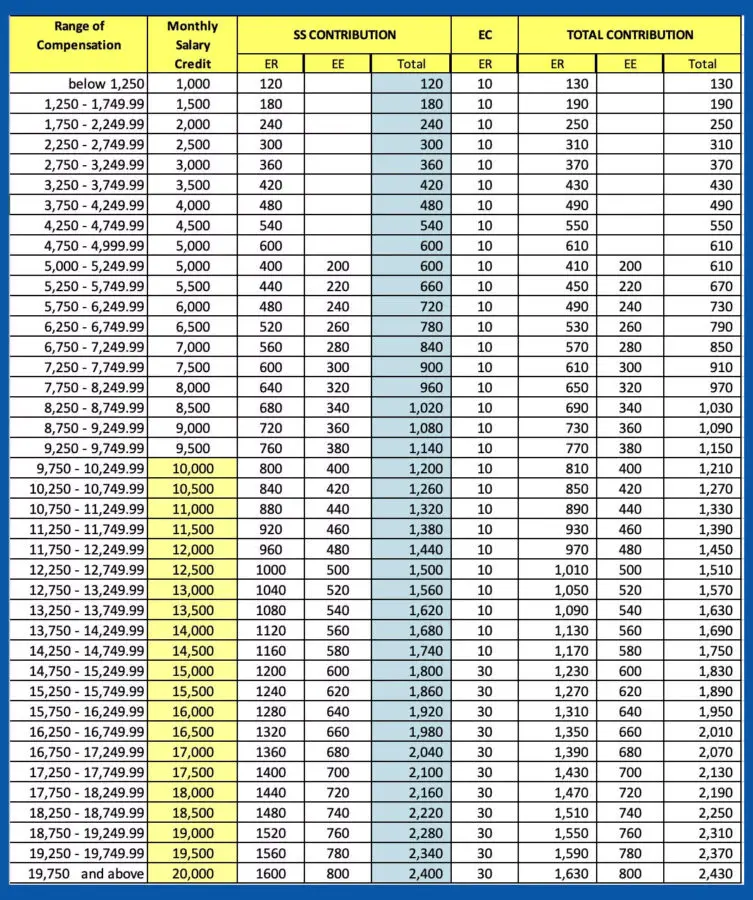

The new sss contribution table for 2019 has been released for employers employee self employed voluntary members kasambahay and overseas filipino workers ofw should know when they are paying the monthly premium. The table below is computed according to sss contribution provision and is generated to aid human resources personnel check for the appropriate sss contribution value.

Sss Contribution Table 2016 2017 Voluntary Monthly Chart Guide

It is aimed at providing benefits for members and their beneficiaries such as pension death funeral maternity leave permanent disability retirement sickness and involuntary separationunemployment.

Sss contribution table 2017 philippines. If you are ofw try to pay or contribute more so that when the time comes and you staying in philippines for good you might receive a much higher monthly sss pension. For detailed sss contribution table you may check below the schedule of contributions for self employed overseas filipino. The members contribution is 11 of the monthly salary credit not more than p16000.

For ofws the minimum salary credit is php5000. While the table below is the sss table of contribution for voluntary ofw or non working spouse of sss members. Sss contribution table 2017 for employers employees and self employed.

The total premium will be shared by the member 363 and the employer 737. If your salary is p 20000 or p 30000 your monthly contribution will be based on p 16000 because its the highest monthly salary credit. Therefore the minimum monthly contribution for ofws is php 550.

Direct housing loan facility for workers organization members. Social security system sss is a philippine social insurance program to workers in the private professional and informal sectors. The sss contribution table below is for self employed individuals voluntary members and overseas filipino workers.

The contributions of a non working spouse sss member depends on the 50 of the monthly salary credit of the working spouse and not lower than php1 000. Non working spouses contribution is 50 of the their working spouses last posted monthly salary credit which should not be lower than p2000. Direct housing loan facility for ofws.

Sss contribution table 2017 sss contribution table provides actual values for employer employee share of sss contribution based on a salary range. For ofws the minimum monthly salary credit is p5000. Housing loan for repairs andor improvements.

Moreover its essential to know the values of contributions if you are an employer because it can be a lawful act if you make mistakes in terms of paying for contributions. New philhealth contribution table for 2017. Every year the contribution table for the social security system sss updates and this is depending on how the economy is.

Heres the sss contribution table for for self employed voluntary and ofws. Sss contribution table 2018 for employer and employed members.

Philhealth Premium Contribution Table 2018 Technobound Review

How To Get Sss Prn New Sss Contribution Table 2020

News And Technology 2017

Sss Contribution Table Effective January 2016 When In Manila

New Sss Contribution Table 2017 Self Employed Overseas Filipino

New Philhealth Contribution Table Effective Dec 7 2019 News To Gov

Angat Ang Makabago Sss Contribution Table 2017 Version

New 2019 Sss Contribution Table

New Sss Contribution Table April 2019 Announcement Philippines